The complexity of Volkswagen’s attempt to bake programmatic into is media strategy spotlights the challenges facing the wider industry now the sale of the car is done online, not at a dealer.

Do not expect a rush from the business to take on all adtech but it will try to take on what it thinks will give it more control and importantly reduce costs. Here is a brand that doesn't’t see the need to pay a partner for commoditsed tools like an ad server when it’s far more feasible to set one up itself.

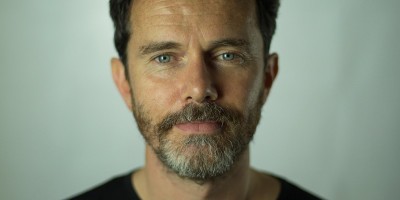

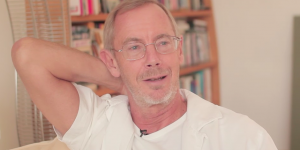

Regardless of what its own burgeoning adtech stack might suggest, the reality is rooted in creating value not conflict, says Volkswagen’s head of communications and media planning Oliver Maletz, who is currently on the hunt for a data management platform (DMP) to sit alongside the ad server it already runs.

Car makers need to work around often having no direct relationship with buyers and the promise of centralsing all the data it owns and buys through one platform like a DMP means Volkswagen can start to capitalize on what has previously been the domain of dealerships.

“Because the sale is made online and the deal is done in the dealership that’s something we’re struggling with internally over how to optimise against, “says Maletz.

What he’s effectively referring to is Volkswagen’s marketing following customer journey. It’s changed “faster than we’ve been able to keep up with,” Maletz admits. And while metrics like average transaction price and average cost per test drive are benchmarks that Maletz believes could help Volkswagen “drive profitability”, they are still arguably just the tip of the iceberg.

Indeed, a widely-held belief among the car industry is that too many dealers rely on traditional attribution measures that fail to quantify quality, reports Wards Auto. For example, dealers continue to rely on traditional “internet leads” in customer-relationship management systems, yet industry knowledge reveals lead forms result in a small percentage of actual purchases within 40-60 days.

Driving away from this isn’t for lack of trying at Volkswagen. Nevertheless, it can only get so far given it’s the dealers that have the rich data because they (not the car manufacturer) sell the cars. Should current contract negotiations between its dealerships worldwide prove fruitful then it could be the upgrade Volkswagen needs to take its digital plan up another gear.

“I firmly believe that if we do it [programmatic] right then we can increase the average transaction price and bring down the average cost per test drive because we’ll be giving the right things to the right people.”

The rationale being that programmatic can’t just be used to buy cheaper inventory and wring more efficiencies from Volkswagen’s media plan, rather its using the DMP to bring new value, increasing the number of the conversions whatever they may be.

Jumpstart automotive media

Volkswagen’s TV investments could benefit from a more data-driven approach should the industry succeed in making it a more accountable medium. “Like most advertisers, we’d welcome addressable TV because it allows us to be more targeting,” says Maletz. “But we [the ad industry] don’t push the TV industry anywhere near as hard as we push the digital industry because it’s much easier to track. Even with the emergence of smart TVs I don’t think it’s going to be immediately solved because yes you might know who’s in the room and you may have a better profile of them based on what’s being watched but you’ll never know whether someone is actually paying attention.”

But creating new value is superfluous in business if it isn’t cost-effective, a conundrum that pushed Volkswagen to look at what happens to its budget once its poured into an ever-fragmenting supply chain. Concerned that the money it thinks it’s giving to publishers isn’t reaching them, Maletz is investigating whether the effectiveness the brand gets from media buys matches what it spends. For now, there is still much of the supply chain to untangle, though Maletz assures that the picture is clearer now.

“In some cases, it can be 15 major publishers are responsible for 80% of the reach. So [with] the other 70% to 85% of publishers, do I really need to spend the money on them? Because they’re giving me incremental reach but they’re putting me in unsafe environments. Once we have that analysis on what is the true impact on a model by model, market by market and audience by audience basis the we’ll be able to see that. It’s a big issue.”

It’s also a big issue for the Guardian’s chief revenue officer, whose own investigation last year uncovered that at worst the publisher gets just 30p for every £1 an advertiser spends on it programmatically. Frustrated by the prospect of some Volkswagen’s money not going on working media, Maletz questioned “at what point does the cost become too much” at the Festival of Media earlier this month. He wonders why advertisers are asked to make investment after investment just to reach the right consumer in an environment that’s meant to be fully transparent and delivering value.

“We’ve got €100 that we would like to go to a publisher but more and more of that is being whittled away to the point where in some cases its €50 of that [initial outlay] is going to just be able to get the ad to the publisher and at that point is it worth it? If I’m going to do programmatic and I have to spend 50% in fees of the €00 is the tradeoff between efficiency or effectiveness worth it now? The technology industry has to consolidate itself somehow,” he adds.

Volkswagen’s accelerating marketing strategy shifts into top gear

At the crux of Volkswagen’s media overhaul is an acknowledgement of the deep-rooted issues with automotive advertising. Car marketing tends to stick to a tried and tested formula: endless shots of sports cars sliding through chicanes, the family road trip in the sedan, classical music as the soundtrack, maybe a cool PR stunt to stir up the emotions of younger drivers.

However, those ads are rarely ever stacked in a way that allows a brand to exploit how someone buys a car now. Cars.com research reveals nearly half (43%) of shoppers don’t contact a dealership before the visit one. Yet, they come armed to the teeth with reviews and insights from several online channels.

Maletz admits: “We haven’t, from a comms standpoint, understood which communications we need to give to help the consumer along the path. We’ve been too focused on our self.”

Furthermore, the business must contend with an industry where its fast-becoming the norm for people to buy from a car marque once every month than the previous once every seven or eight years. “Historically we’ve thought about how do I launch this vehicle and then tended not to worry about it anymore but from our perspective what do we want to say about the car versus what do consumers need to hear to make their decision,” explains Maletz.

To make this happen the German brand has not only changed the way it plans its marketing but also the way it briefs agencies. Everything now starts from a communications plan that has the media strategy not the creative idea as the focal point, meaning ideas are expected to be built around a customer not a slick TV spot.

“It’s the lower funnel activity that we tended to miss and bigger creative agencies tended to forget because we either weren’t asking the right questions or they’re used to telling stories in a 30-second or 45-second environment,” says Maletz. “Now, we’re not that far ahead yet where we’re saying [to agencies] ‘don’t do TV’ because obviously, we will but if it were just up to me I’d say, ‘show me the creative in all environments except TV’.”

Questions like these will no doubt be commonplace in the meetings between Volklswagen and its recently appointed media agency PHD. Maletz has previously spoken about why the union is different to others, explaining that he no longer asks media agencies just to 'save money' but to focus on strategy as well.

“Our deal with PHD includes very strong performance based elements to it…it has to because we’re paying the agency to add a value not just to add a service,” adds Maletz. “If they do a better job then we have very specific criteria and very specific things that they need to fulfil both in account management relationship but as well the performance of the investment that we give.”